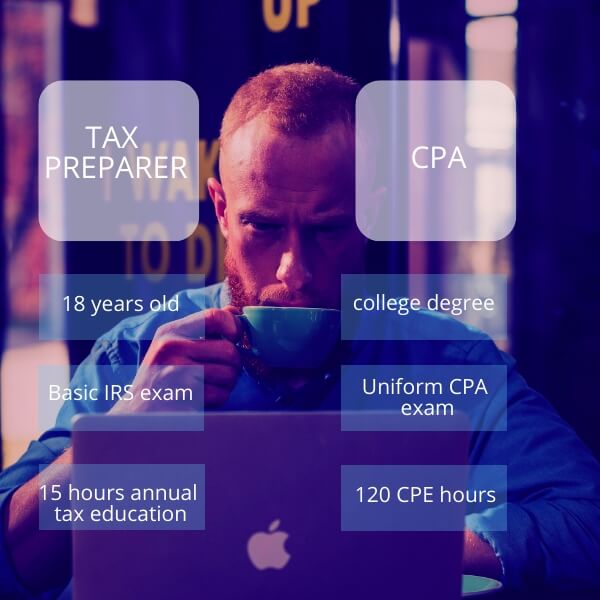

If you decide to use a tax professional, you will generally find two main categories of tax service providers: the licensed tax professional—a Certified Public Accountant (CPA), or the unlicensed tax professional—a tax preparer. So which one should you choose?

The answer really depends on your needs. If your tax situation is simple enough that you just need your income and deductions organized on a tax return, then you can get by using a tax preparer and generally paying a lower fee. However, if your tax needs require added value knowledge and service, then you should work with a CPA or CPA firm such as Gamburg CPA PC.

We will describe the main differences between the two categories to give you a better idea about what will be the best fit for your tax situation.

The tax preparer category generally includes non-licensed professionals who are subject to minimal regulation, if any at all. That means that tax preparers are not required to take Continuing Education Courses (CPEs), which are a requirement for all CPA professionals. Taking these courses not only provides professional expertise, but also enhances a professional’s knowledge of new laws and tax planning strategies. Additionally, a tax preparer’s lack of licensing will limit their ability in discussing your particular tax situation upon a notice or examination by the Internal Revenue Service (IRS) or state tax authorities.

The lack of licensing also gives tax preparers a window to take aggressive (and sometimes illegal) tax positions without disciplinary action by regulatory agencies. When reviewing the prior year’s taxes of a potential client that I met with last year, I noticed that his gross income was $40,000 and took a charitable deduction for $25,000. When I asked him about it, he claimed he was not aware that the tax preparer had deducted such a high amount last year and confirmed that he had not made any charitable donations in the previous year. In this case, the question was obvious: how do you make a $25,000 charitable donation, when your net income is approximately $30,000?

Do you review your tax return before you sign it to make sure that such a thing will not happen to you? Some tax preparers might be willing to let their clients take such a risk in order to get a higher refund; most CPAs however, will not risk losing their license for you. This is not to say that all CPAs are honest, because some have lost their license and even went to jail.

Work with Honest People

In my opinion, most tax preparers are honest as well, and only a few pride themselves on obtaining large refunds in illegal ways. This example serves to caution you to review your return and not to take excessive deductions, especially with increased enforcement by the IRS and state tax authorities.

Make sure that any tax position taken is legal and well-researched beforehand. Generally, a CPA will have better tools and more insight to assist you in researching complex tax positions, as well as a larger knowledge base that they can apply in minimizing your tax liability, within the limits of the tax code.

CPAs are generally more concerned with performing quality work, as opposed to sheer quantity. Our firm might even recommend clients to tax preparers if we feel that their tax situation is simple enough that we cannot provide any added value. For example, several clients we have met with in the past several years have only had income from employment wages (W-2 form); which would result in a tax return that our firm cannot offer any additional expertise in the preparation of, while also charging a higher fee for the same end result.

Using a CPA will also give you the value of year-round service; you can always call during the year or get additional services, especially if you have a business. Some tax preparers provide their services on a seasonal or part-time basis, and might not always be there to answer your questions or deal with tax notices once tax season is over.

Any person can become a tax return preparer; you just need to present yourself as one.

Some people might just read a few books and start doing taxes. A CPA has to obtain a proper degree, pass a complicated exam, obtain professional experience, and face regulation by a state board. Without completing the proper degree, tax preparers will not have the basic accounting skills required to prepare business tax returns. Additionally, simple items like loss carryovers from prior years can be omitted on your current year’s tax return due to a lack of understanding.

If your tax situation is easy enough you should use a tax return preparer because you will probably get no added value from using a CPA and will most likely pay less money to get your taxes done. A tax preparer can take your various income items, input them to tax return software, and press print. Most people can take items and input them to any software that they know how to use, but this is also assuming that they know the rules. For example, a tax preparer can enter partnership losses into tax software, but does he know whether the partner in question has the tax basis to deduct the losses?

The software has the ability to limit those losses if you also enter the basis information, but does your tax preparer knows how to calculate your basis, which could be very complex at times?

If you have a complex tax situation and you feel that you need added value knowledge and service, you are better off using a CPA.

Now the only question left is how to choose the right CPA?

You need to weed out the CPAs that act as tax preparers, in going after the quantity over quality. Also, you need to choose a CPA professional or firm that you can trust and feel comfortable working with. If you have one like that already, you should stick with them because it is very hard to find a good CPA. The number one reason why our clients switch from their previous CPA to our firm is because they were not proactive. One of our clients said it best: “I think I have a good accountant, but I am not sure I know what is going on and that I am getting the best value for my money.”

Remember that anyone can become a tax preparer, but not everyone can be a CPA, and not every CPA can give you the right professional guidance. Review your tax situation and see whether you only need a tax preparer to input your information to tax software; or if that is not enough, then you need a CPA or CPA firm. However, make sure to choose the right CPA professional with a proactive approach.

Gamburg CPA PC will be happy to review your tax situation and advise you on what is the best fit for you. We generally recommend the services of a CPA if your tax situation is more complex than wages and a few interest income items. Here is another way to look at this: the point of buying insurance is to protect you if something happens, right? Using a CPA is a sort of insurance policy for your taxes and is worth the extra cost, especially if your tax situation is complex. Are the hassles and headaches involved in dealing with notices and audits from the IRS or state tax authorities really worth saving a few dollars on your tax preparation?

Gamburg CPA PC is a young and fast-growing CPA firm that provides preparation of tax returns for all entities on a federal and state level, tax planning and analysis throughout the year, audit representation, consultations about international tax issues and compliance, assistance with business entity selection, and accounting and bookkeeping services.

Our expertise ranges from multi-million dollar high net worth individuals and businesses in various industries to small businesses’ and individuals’ everyday tax needs.

At Gamburg CPA PC, we use a proactive approach and innovative thinking within the limits of the tax code to tackle tax problems and find solutions for the future for our clients. We believe in building a strong and productive business relationship by communicating with our clients and getting to know their needs. We use a value added approach and look at the overall picture for our clients.

As a young CPA firm, providing the highest level of quality service is even more important to us when compared to other CPA firms. If we lose clients, how are we going to grow and thrive in the market?

Our clients stay with us because we provide them with the highest level of quality service and we would like to do the same for you.